Pig E. Bank

To better understand the leading causes to customers leaving the bank, Pig E. Bank management has requested analysis of its customers’ demographics to understand them better. These insights will advise management on how to better retain customers..

Tools used

Excel

Powerpoint

Skills required

Data wrangling and subsetting

Consistency checks

Data merging

Deriving variables

Identifying PII data

Grouping and aggregating data

Vlookup

Understanding decision trees

Reporting in Excel

Data available

Initial Exploratory Analysis

Working to understand the tables, data available, and relationships between tables

Identify data issues to be addressed including:

PII data to be removed to protect customer identify

Data inconsistencies such as abbreviations and full words mixed in a column

NULL values present

Less useful ambiguous values in certain columns

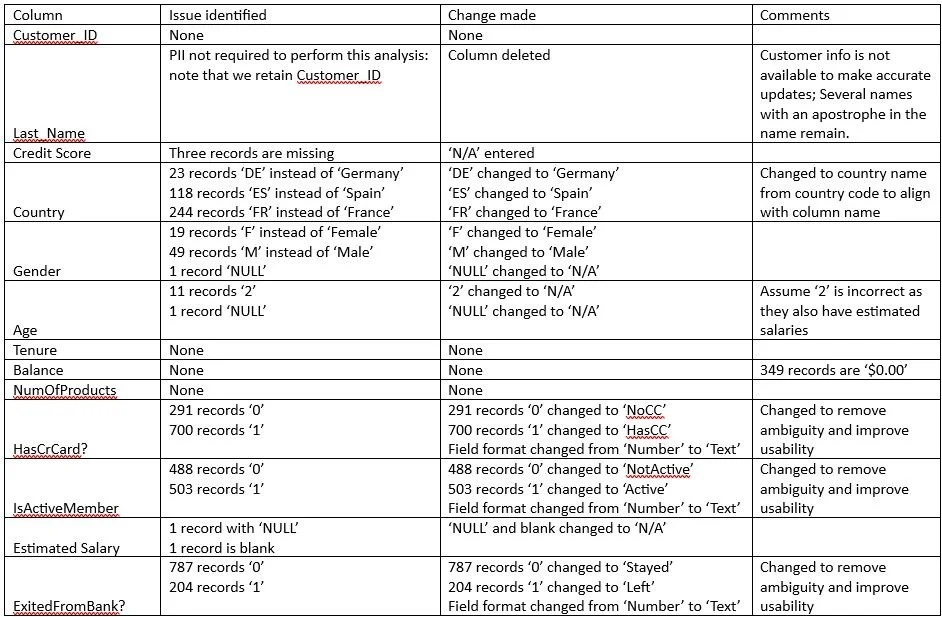

Data Checks and Cleaning

Testing the data integrity and cleaning the data as needed

Data issues identified are cleaned.

No data was imputed as it would have had a significant impact on the results with so few records.

The HasCrCard, IsActiveMember, and ExistedFromBank fields were converted from boolean values to text.

(Changing the boolean values to text was done to make reporting more effective and impactful. Typically, I consider the balance between usefulness and efficiency when addressing this.)

Analysis

Provide full analysis of the data to better understand Instacart’s customers and products and address management’s questions

Customer Demographics vs Customer Retention

All available customer attributes have been assessed to understand their impact to customer retention

Decision tree to determine customer retention

According to the customer demographic analysis, this decision tree captures the primary challenges with customer retention

This can then be used to determine if a customer is expected to stay with Pig E. Bank

Customer Retention Decision Tree

Pig E. Bank Final Report and Recommendations

The decision tree to identify customers at risk of leaving the bank can be used to assess each customer per the criteria below:

The customer attributes that have the highest impact on increasing customer retention:

High Customer activity

Under 40 years old

Female

Bank balance over $100,000

Other attributes have shown less impact:

Credit score

Country

Tenure

Number of Products

Having a credit card

Salary